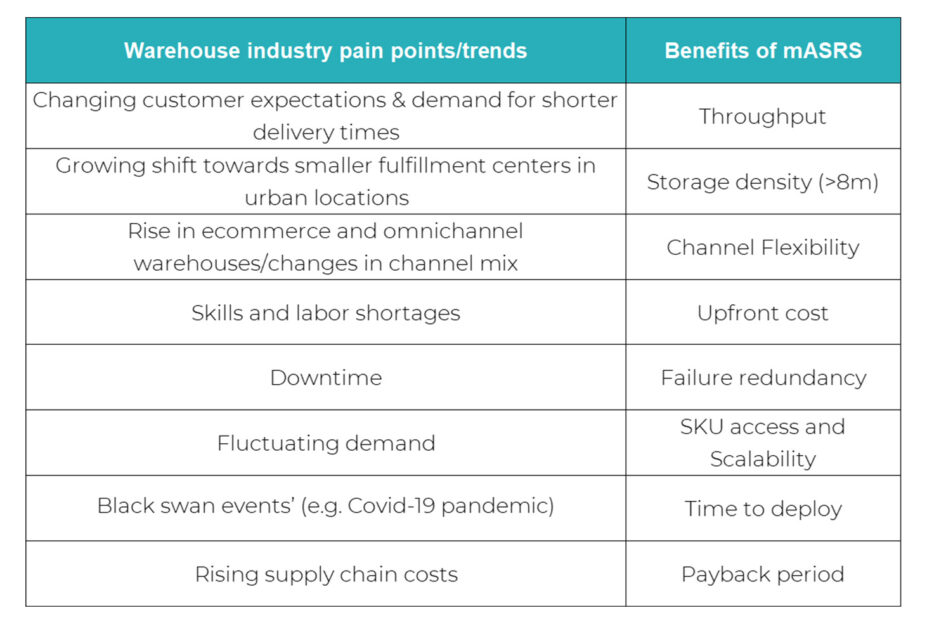

Research carried out by market intelligence specialist Interact Analysis demonstrates the key benefits of Mobile Automated Storage and Retrieval Systems (mASRS) and how they address 8 pain points and trends for warehousing. These include changes in channel mix, evolving retail habits, labor and skills shortages, and rising supply chain costs. With a maximum rack height of 12m, mASRS are designed to optimize storage and retrieval processes in the warehouse. The technology occupies a “sweet spot” in the market by balancing the competing capabilities required of warehouse automation solutions and addressing evolving industry needs (see chart below).

mASRS systems score highly in comparison with other G2P solutions across a range of different metrics

Source: Interact Analysis 2024

1. Changing Consumer Expectations

Consumers are demanding faster delivery times. Data from Interact Analysis shows average delivery times for online grocery orders fell from 2 days to eight hours between 2020 and 2022, with a further fall to 4 hours predicted by 2030. Exotec’s Skypod system, a mASRS, provides a 5x improvement in throughput, access to any SKU (stock-keeping unit) in under two minutes, and features such as reverse picking to facilitate faster delivery.

2. Growing Shift Towards Smaller Fulfilment Centers in Urban Locations

Companies are looking to move inventory closer to customers to reduce distribution costs and cut delivery times. To do that they are increasingly utilizing fulfillment centers in urban locations that typically suffer from space limitations. mASRS provides high storage density, up to a maximum height of 12m, allowing businesses to carry and access their extensive inventory quickly.

3. Rise in e-Commerce and Omnichannel Warehouses & Changes in Channel Mix

Online sales have risen sharply, fueled by the pandemic. This has forced warehouses to pivot from store fulfillment to e-commerce and led to a growing number of omnichannel warehouses. Data from the Census Bureau of the US Department of Commerce indicates US e-commerce sales rose by 7.6% during the third quarter of 2023, compared with the same period in 2022. For today’s omnichannel operations, achieving the optimal balance of throughput, density, and flexibility is key, particularly with an expanding number of SKUs (stock-keeping units). Decoupling throughput from storage provides the channel flexibility needed to adapt systems to changing needs, while the ability to support both “each” and “case” picking allows the system to support both store replenishment and e-commerce.

4. Skills and Labor Shortages

Our research indicates scarcity of labor remains the biggest factor driving demand for mobile robots. The U.S. Chamber of Commerce reports labor force participation dropped from 63.3% in February 2020 to 62.5% in January 2024. Warehouse automation technology provides an increase in throughput with reduced headcount, and advanced control systems mean mASRS are safe and accurate to operate alongside human workers. Furthermore, upfront costs are reduced due to the flexibility of the system which allows businesses to get the throughput and storage that they need today, and scale later as opposed to building a system to grow into.

See how the Exotec Skypod system delivers exceptional reliability to warehouses of top global businesses.

5. Downtime

Even a single minute of downtime can cost thousands of dollars, making failure redundancy a key factor for choosing a warehouse automation system. mASRS scores highly on uptime due to a built-in redundancy of having a fleet of interchangeable AMRs operating the system. If a robot fails, it removes itself from the system for repair while a spare takes its place to maintain uninterrupted operations.

6. Fluctuating Demand

Businesses experiencing seasonal peaks and troughs need a system that is scalable and able to cope with changing inventory demands. mASRS have modular racking, which can be installed within weeks, and individual, interchangeable AMRs, which can be rented for peak seasons and added within minutes. The scalability and flexibility of mASRS technology are helping drive up adoption rates.

7. Black Swan Events

The COVID-19 pandemic was a black swan event leading to a sharp rise in demand for warehouse automation and more flexible solutions. Companies should ensure their operations are robust and future-proof. For example, persistent labor shortages in recent years have had a huge impact on fulfillment operations. mASRS is quick to install with deployments that take months, not years. The fastest installation to date only took six weeks.

8. Rising Supply Chain Costs

Supply chain costs continue to rise, pushed up by factors such as rising fuel costs. Coupled with growing demand for shorter delivery times and e-commerce, this is placing substantial pressure on warehousing operations. Companies are looking to move fulfillment operations closer to consumers to cut delivery times and distances. With a short payback period, mASRS technology can help drive down supply chain costs in the near term by increasing throughput and space optimization.

To find out more about the evolution of ASRS technology and mASRS solutions, read our new whitepaper – jointly produced with leading global market research firm Interact Analysis:

Share

Insights

-

April 15, 2025Top Warehouse Trends for 2025: Future of Automation

-

April 9, 2025Material Handling: Basics, Benefits, & Automation

-

April 4, 2025Complete Guide to Pick-and-Place Automation

News

-

April 16, 2025Exotec achieves SOC2 Type 2 Compliance, just months after obtaining ISO/IEC 27001:2022 Cybersecurity Certification

-

March 24, 2025Exotec Showcases Next-Gen Skypod System at ProMat 2025

-

March 17, 2025Exotec Announces Partnership with Oxford Industries to Implement Next Generation Skypod System in New Multi-Brand Distribution Center

Events

-

May 7, 2025Exodinner: Indianapolis, IN

-

May 22, 2025 | Cincinnati, OHExotour: Cincinnati, OH

-

May 28, 2025Exodinner: Vancouver, BC